Where are property taxes highest and lowest? Analysis of cities and states

The Midwest and Northeast states carry the highest tax rates, led by Illinois and New Jersey. Here’s a look at the rest.

The Midwest and Northeast states carry the highest tax rates, led by Illinois and New Jersey. Here’s a look at the rest.

Nearly 30% of Americans would marry for money in current economy, survey reveals

Love or money? A new survey finds many Americans weigh financial stability heavily in romance – and some even stay in relationships for the paycheck.

Love or money? A new survey finds many Americans weigh financial stability heavily in romance – and some even stay in relationships for the paycheck.

Debt collection calls spiked in 2025: Here's where

Complaints about debt collection calls rose sharply across the country in 2025, according to new data from the Federal Trade Commission.

Complaints about debt collection calls rose sharply across the country in 2025, according to new data from the Federal Trade Commission.

Stimulus payment February 2026, IRS direct deposit relief, tariff dividend & tax refund fact check

Claims about new stimulus checks, IRS direct deposits, relief payments and tariff dividends spread throughout 2025 — and they’re still circulating in 2026. But is there any truth to them?

Claims about new stimulus checks, IRS direct deposits, relief payments and tariff dividends spread throughout 2025 — and they’re still circulating in 2026. But is there any truth to them?

Eddie Bauer retail operator files for bankruptcy, begins liquidation sales

The 106-year-old brand founded in Seattle will begin liquidation sales while seeking buyer for brick-and-mortar operations.

The 106-year-old brand founded in Seattle will begin liquidation sales while seeking buyer for brick-and-mortar operations.

Walmart boosts pay potential for some pharmacy staff, college degree not required

Walmart is expanding higher-paying pharmacy leadership roles and boosting earning potential for thousands of workers.

Walmart is expanding higher-paying pharmacy leadership roles and boosting earning potential for thousands of workers.

Here's what Americans are saying about the economy, stock market outlook in 2026: Poll

Americans hold a mixed outlook on the economy over the next six months, according to a new Gallup poll.

Americans hold a mixed outlook on the economy over the next six months, according to a new Gallup poll.

Trump Account commercial airs during Super Bowl: Here's what to know

During the Super Bowl, a commercial aired touting President Trump’s new investment accounts for American children. Here’s what they are, and how they work.

During the Super Bowl, a commercial aired touting President Trump’s new investment accounts for American children. Here’s what they are, and how they work.

Why medals at the 2026 Winter Olympics are worth more than ever

Record prices for gold and silver make the 2026 Olympic medals the most valuable ever. Here's a look.

Record prices for gold and silver make the 2026 Olympic medals the most valuable ever. Here's a look.

Dow Jones hits record 50,000 points for first time: What to know

The U.S. stock market roared back Friday, as technology stocks recovered much of their losses from earlier in the week.

The U.S. stock market roared back Friday, as technology stocks recovered much of their losses from earlier in the week.

Mastering the dollar: These cities rank as the top budgeters in 2026, data suggests

From credit card debt to daily spending, residents in specific areas nationwide have implemented best practices when it comes to living on a budget, according to a new report.

From credit card debt to daily spending, residents in specific areas nationwide have implemented best practices when it comes to living on a budget, according to a new report.

What is the Houston Land Bank?

The Houston Land Bank works to create affordable homes in neighborhoods across Houston to help provide a better quality of life for underserved communities. Consumer Reporter Heather Sullivan talks with CEO Christa Stoneham and Khiana Goines, who just purchased her first home with the help of the Houston Land Bank.

The Houston Land Bank works to create affordable homes in neighborhoods across Houston to help provide a better quality of life for underserved communities. Consumer Reporter Heather Sullivan talks with CEO Christa Stoneham and Khiana Goines, who just purchased her first home with the help of the Houston Land Bank.

Texas man pleads guilty in $2.1 million ‘meme stock’ Ponzi scheme

A Mont Belvieu man faces up to 20 years in prison after pleading guilty to running a $2.1 million "meme stock" Ponzi scheme that defrauded his friends and colleagues.

A Mont Belvieu man faces up to 20 years in prison after pleading guilty to running a $2.1 million "meme stock" Ponzi scheme that defrauded his friends and colleagues.

Judge blocks Texas law prohibiting state investment in anti-fossil fuel companies

A Texas law requiring state entities to sever ties with financial companies that "boycott fossil fuels" has been blocked by a district judge.

A Texas law requiring state entities to sever ties with financial companies that "boycott fossil fuels" has been blocked by a district judge.

MC3 apprenticeship readiness program

Billions of dollars worth of construction projects are coming to the Houston area, but there is a shortage of skilled trades workers to fill the jobs. Heather Sullivan has information on a paid training program so you could secure a job.

Billions of dollars worth of construction projects are coming to the Houston area, but there is a shortage of skilled trades workers to fill the jobs. Heather Sullivan has information on a paid training program so you could secure a job.

Texas jobs: Final 2025 workforce numbers show above-average growth

Texas added over 19,000 jobs in December, rounding out 2025 as a historic year of growth for the labor force, according to new data from the state's workforce commission.

Texas added over 19,000 jobs in December, rounding out 2025 as a historic year of growth for the labor force, according to new data from the state's workforce commission.

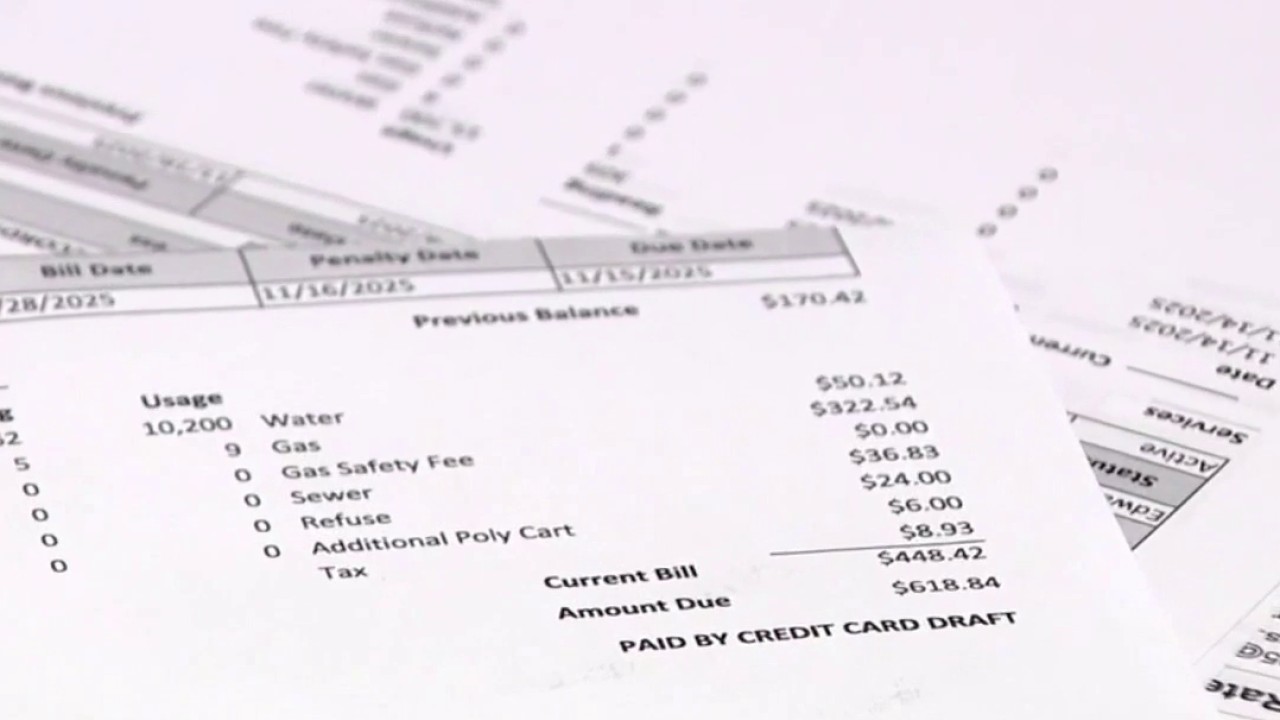

Waller homeowners to receive natural gas bill relief

Some relief is coming for homeowners in the City of Waller who have been hit by high natural gas bills reaching $400 to $500 a month or more this winter. Consumer Reporter Heather Sullivan spoke to homeowners impacted by the high bill costs.

Some relief is coming for homeowners in the City of Waller who have been hit by high natural gas bills reaching $400 to $500 a month or more this winter. Consumer Reporter Heather Sullivan spoke to homeowners impacted by the high bill costs.

Tariffs may have cost US economy thousands of jobs monthly, Fed analysis reveals

A new Federal Reserve analysis found that tariffs may have slowed job growth in the U.S. economy in 2025.

A new Federal Reserve analysis found that tariffs may have slowed job growth in the U.S. economy in 2025.

What Trump’s next pick to lead the Federal Reserve means for your wallet

The Fed’s decision about rate cuts will shape the economy’s trajectory and how affordable life feels for millions of Americans in the new year.

The Fed’s decision about rate cuts will shape the economy’s trajectory and how affordable life feels for millions of Americans in the new year.

Galveston cruise boom | Sullivan's Smart Sense

The Port of Galveston is now the 4th most popular port in the country for cruising. Consumer Reporter Heather Sullivan talks with Port CEO Rodger Rees about new ships, terminals, and more in the Port.

The Port of Galveston is now the 4th most popular port in the country for cruising. Consumer Reporter Heather Sullivan talks with Port CEO Rodger Rees about new ships, terminals, and more in the Port.