Texas Senate seeking to break impasse with 'historic' property tax relief plan

Counter-offer delivered to break Property Tax dead-lock

State lawmakers may be closer to an agreement on Property Tax Relief. FOX 26 Political Reporter Greg Groogan shares what deal senators have offered members of the house.

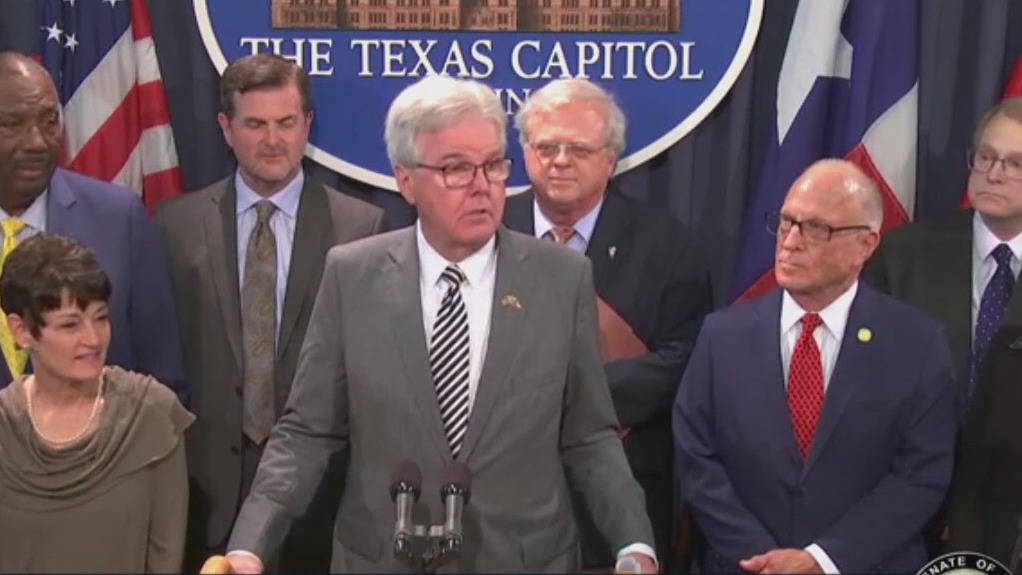

Texas - Standing shoulder-to-shoulder, all 31 members of a united Texas Senate delivered what they hope will be a stalemate-busting bid to deliver their constituents historic relief from taxation.

"This bill will give homeowners an approximately 41% cut in their school taxes. It will give businesses the biggest tax cut they've ever had," said Lt. Governor Dan Patrick, leader of the State Senate.

The proposal approved unanimously by the upper chamber, raises the amount set aside for tax relief by $400 million to a total of $18 billion.

SUGGESTED: Texas Senate passes new property tax-cut plan

In what amounts to an olive branch to the House, the latest Senate measure completely eliminates the State's franchise tax on 67,000 small businesses and drops the so-called "rollback back" rate for local tax hikes without voter approval from 2.5 percent to 1.75 percent.

"That's a 30 percent reduction in the future levies that all Texas taxpayers have to pay school districts," said State Senator Paul Bettencourt of Houston.

Texas Lt. Governor delivers ultimatum on property tax relief

*EDITOR'S NOTE: This video is from a previous story. Lt. Gov. Dan Patrick is demanding the State House work on property tax relief. FOX 26 Political Reporter Greg Groogan shares what else he said during a stop in Houston.

Senate Democrats joined Patrick in urging the House to accept the deal.

"This is the right thing for Texans and at the end of the day, people need to stop feeling like they are renting their homes from the state," said State Senator Jose Menendez of San Antonio.

MORE: Texas Lt. Governor delivers ultimatum on property tax relief

"Enough is enough, it's time for the House and the Speaker to come back to Austin," said State Senator John Whitmire of Houston.

According to Bettencourt's calculations, the new Senate plan offers annual savings of $1,270 dollars per year for the average Texas homeowner with seniors tacking an additional $180 onto that.

"We ask our colleagues in the House to come back and give this bill serious consideration. The taxpayers are waiting for their tax cut and the clock is ticking," said Patrick.

CLICK HERE TO DOWNLOAD THE FOX 26 HOUSTON APP

With six days remaining in the special session, Patrick contends there is time enough to push through tax relief.

While neither Abbott nor House Speaker Dade Phelan have offered comment yet, Quorum Report editor Scott Braddock tweeted, "Gov Abbott's office indicates the New Texas Senate property tax plan is a non-starter."

Both Phelan and Abbott have so far opposed increasing the homestead exemption, opting instead for a House plan which devotes the entire amount allocated to "compressing" school taxes for all property owners, delivering an additional benefit to corporations and those with large commercial holdings.