Texas businesses look for inventory tax relief from legislature

Inventory tax challenged in legislature

Texas lawmakers will have their hands full with a variety of topics during the new legislative session and among them is a plea from the state's businesses for some relief from an inventory tax. FOX 26's Business Reporter Tom Zizka reports more on the tax.

HOUSTON - Texas lawmakers will have their hands full with a variety of topics during the new legislative session. Among them is a plea from the state's businesses for some relief from a tax that they would not face in much of the country.

Texas is among nine states that have an Inventory Tax levied on the products, materials, and equipment that a business uses to keep its doors open. Businesses are arguing the state can afford to cut them a break.

SUGGESTED: US inflation slows to 6.5% over past 12 months, easing some pressure

Like all the state's businesses, Exclusive Furniture owner Sam Zavary recently paid his inventory tax, and he wasn't happy about it. "Having a tax on inventory, I never understood it," he says.

With a warehouse that supplies eight stores, everything from products and equipment, like trucks and computers, gets taxed. "It's huge," says Zavary, "It's close to 3.6 to 3.7%. So, if you have a million dollars worth of inventory, at the end of the year, you have to pay that 3.6 to 3.7%."

For those who need a little help with the math, that million dollars worth of inventory means a $36,000 to $37,000 tax bill every single year.

As the new legislative session gets to work with a $33 billion surplus, Governor Abbott has proposed massive property tax relief, and support for inventory tax relief, "This is a once-in-a-generation opportunity."

RELATED: Biden: Easing inflation 'giving families some real breathing room'

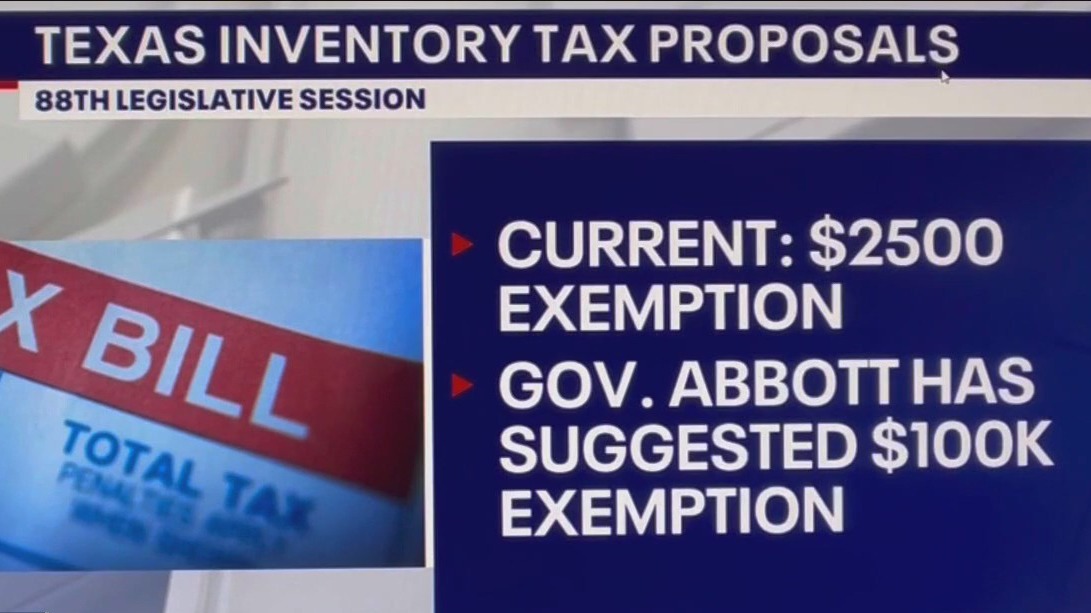

Rather than a seemingly-slim $2,500 exemption on inventory value, the governor has suggested lifting it to a $100,000 exemption. The business trade group National Federation of Independent Businesses is lobbying lawmakers and will push for a $250,000 exemption they say would assist businesses still struggling with ever-rising costs, that could use the money to grow and hire.

READ MORE STORIES ON THE ECONOMY

"They're still on the road to recovery," says NFIB Texas director Annie Spilman. "They're still dealing with inflation, and supply chain issues, and labor shortages. Texas needs to help our small business owners."

Some other states with an inventory tax, like West Virginia and Louisiana, have tried cutting the rate only to find they really missed the money and backtracked on the cuts.

Texas business supporters say the state has more resources to make the move, absorb the losses, and improve the Texas business climate in the process.