Abbott signs $10 billion property tax relief package

Governor Abbott signs $10 billion property tax relief package

Gov. Greg Abbott is signing a $10 billion property tax relief package into law, aimed at benefiting homeowners, seniors, and businesses. The tax cuts are not yet final; they must be approved by Texas voters in the constitutional amendment election this November

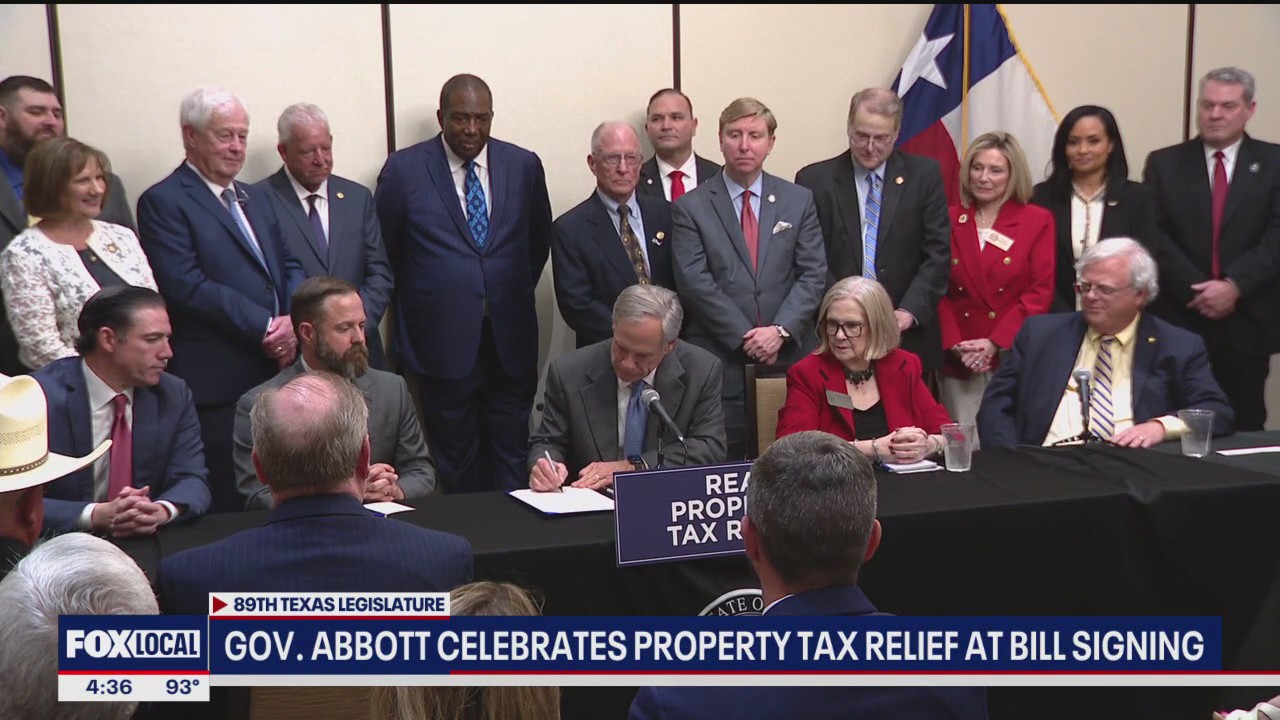

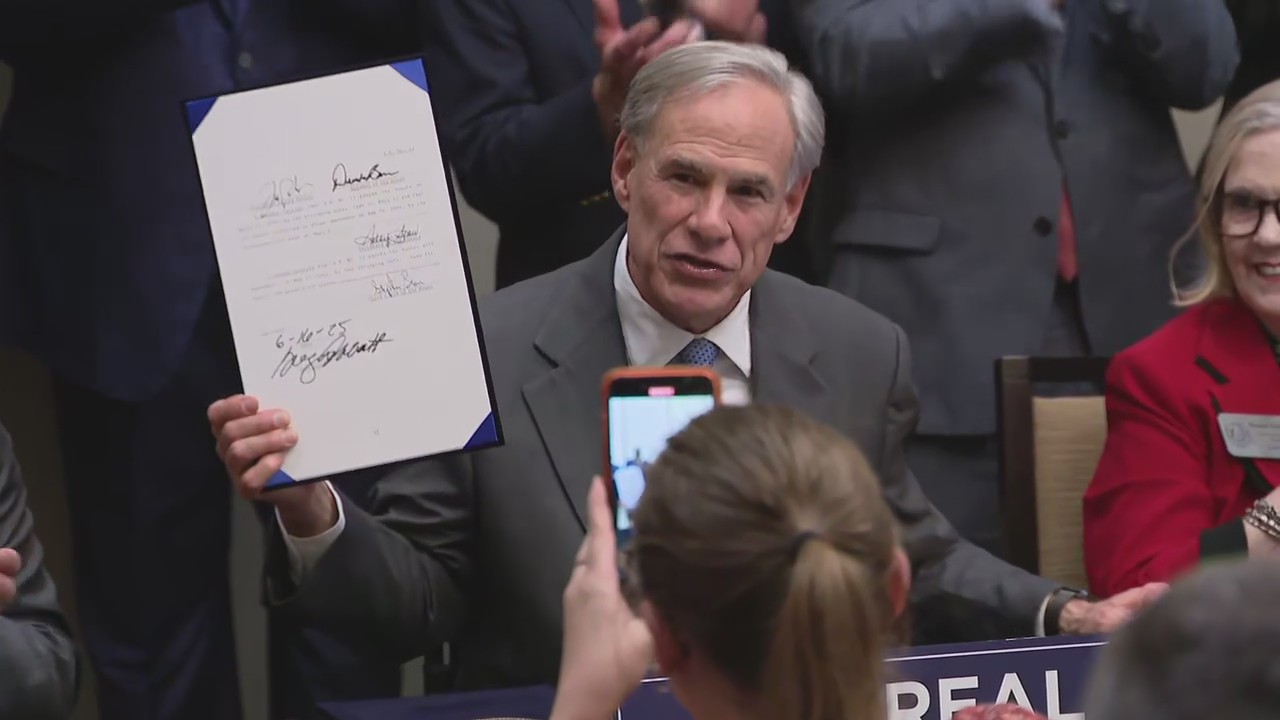

DENTON, Texas - Gov. Greg Abbott signed a $10 billion property tax relief package into law on Monday, a measure proponents say will provide significant savings for homeowners, seniors, and small business owners across Texas.

Gov. Abbott signs $10B property tax relief package: FULL

Governor Greg Abbott signed three bills in Denton on Monday aimed at lowering property taxes for Texans.

The signing ceremony for three key bills was at the Robson Ranch Clubhouse in Denton. The legislation, a product of the 89th Legislature, will go before voters for final approval in the November 2025 constitutional amendment election.

The bills were passed with near unanimous support from the House and Senate this session.

Details of the Tax Relief Bills

Gov. Abbott to sign SB 4, SB 23, HB 9 into law

Governor Greg Abbott is scheduled to sign Senate Bill 4 (SB 4), Senate Bill 23 (SB 23), and House Bill 9 (HB 9), a key part of the 89th Legislature’s $10 billion property tax relief package, into law on Monday, June 16, 2025, at 3:00 PM at the Robson Ranch Clubhouse Legacy Room in Denton, Texas.

Big picture view:

The package includes Senate Bill 4, Senate Bill 23, and House Bill 9. Authored by state Sen. Paul Bettencourt, R-Houston, and state Rep. Morgan Meyer, R-Dallas, the bills aim to build on previous tax-cutting efforts.

"SB 4 and SB 23 builds on the 2023 momentum of the largest property tax cut in U.S. history, a record-breaking $22.7 billion, with targeted exemptions to help millions of Texans," Bettencourt said.

The specific measures include:

- Senate Bill 4: This bill would increase the homestead exemption for school district taxes from $100,000 to $140,000. This is projected to save the average homeowner $484 annually.

- Senate Bill 23: This legislation raises the property tax exemption for Texans over 65 and those with disabilities from $10,000 to $60,000. When combined with the proposed homestead exemption, their total exemption would reach $200,000, resulting in an average annual savings of over $950 for more than 2 million homeowners.

- House Bill 9: This bill targets small businesses by raising the exemption for business personal property to $125,000. The projected average annual savings for business owners is $2,500.

What they're saying:

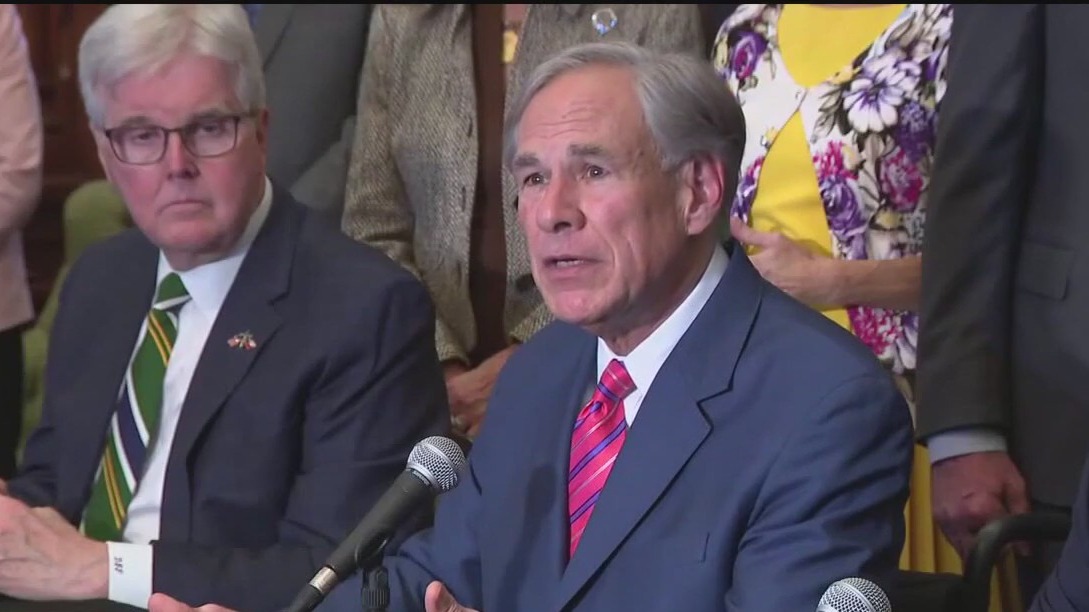

"No state in the history of America has devoted such a large percentage of their budget to tax relief in the United States of America. And as far as I'm concerned, we're not done yet," said Abbott.

Support from State Leadership

Lt. Gov. Dan Patrick praised the collaborative effort behind the legislation.

"The Senators and our House colleagues from both sides understand when increased homestead exemption and more compression are combined, Texans receive maximum tax relief benefit," Patrick said in a press conference. He stated that when combined with a $22.7 billion tax cut from the previous session, Texas homeowners will see a total average reduction of $1,762.87.

The passage of these bills into law is contingent on voter approval in November. Bettencourt expressed confidence that Texans will support the measures, citing similar approvals in 2015, 2022, and 2023.

"This will help millions of Texans stay in their homes, let seniors age in place, and allow others to grow their businesses for generations to come," Bettencourt said.

Concerns over property taxes

The other side:

Some, like Texas Rep. Brian Harrison (R-Waxahachie), have raised concerns about the effectiveness of the property tax relief package and if Texans will see savings.

Harrison says increasing appraisals will likely offset any relief provided by the bills.

"By failing to deal with property taxes with the seriousness that issue deserves, we continue to fail the hardworking and overtaxed men and women of the great State of Texas," said Harrison during the legislative session.

An economist who spoke to FOX 4 at the time that the bills passed said renters likely won't see the cost saving passed down to them in rent.

The Source: Information in this article comes from a news release issued by Senator Paul Bettencourt's office at the State Capital.