New study shows average American pays over $130K in interest fees, but they don't have to

Americans are paying more than $130K on average in interest fees, but there are ways to lower it.

Americans are paying more than $130K on average in interest fees, but there are ways to lower it.

Capital One introduces new student rewards cards - how to find the right one for you

Capital One introduced two new student credit cards, and is doing a giveaway in celebration. (iStock)

Capital One introduced two new student credit cards, and is doing a giveaway in celebration. (iStock)

47K veterans and active-duty troops will automatically receive student loan relief — do you qualify?

Select student loan borrowers who served in the military will have their federal student loan interest retroactively waived, according to the Education Department. See what else veterans and active-duty service members may qualify for, including permanent disability discharges, the suspension of loan payments and other COVID-19 emergency relief measures.

Select student loan borrowers who served in the military will have their federal student loan interest retroactively waived, according to the Education Department. See what else veterans and active-duty service members may qualify for, including permanent disability discharges, the suspension of loan payments and other COVID-19 emergency relief measures.

Today's mortgage refinance rates: 20-year rates return to record low | August 25, 2021

Check out the mortgage refinancing rates for August 25, 2021, which are mostly unchanged from yesterday.

Check out the mortgage refinancing rates for August 25, 2021, which are mostly unchanged from yesterday.

Today's mortgage rates tumble for three out of four terms | August 25, 2021

Check out the mortgage rates for August 25, 2021, which are trending down from yesterday. (iStock)

Check out the mortgage rates for August 25, 2021, which are trending down from yesterday. (iStock)

1.45M homeowners are seriously delinquent as foreclosure moratorium expires

Mortgage delinquencies are decreasing but they are still much higher than before the pandemic began.

Mortgage delinquencies are decreasing but they are still much higher than before the pandemic began.

How to pay off student loans in 5 years: A step-by-step guide

If you want to pay off your student loans in five years, consider boosting your income, cutting unnecessary expenses and refinancing your loans.

If you want to pay off your student loans in five years, consider boosting your income, cutting unnecessary expenses and refinancing your loans.

Having a college degree can double your earning potential, but only if you do this

A college degree can pay off in the form of higher earning potential, but the total cost of attendance causes many students to take out debt. See a few ways to borrow undergraduate student loans without eating into your income.

A college degree can pay off in the form of higher earning potential, but the total cost of attendance causes many students to take out debt. See a few ways to borrow undergraduate student loans without eating into your income.

Today's 10-year, 15-year mortgage refinance rates approach one month at near-record lows | August 24, 2021

Check out the mortgage refinancing rates for August 24, 2021, which are mostly unchanged from yesterday.

Check out the mortgage refinancing rates for August 24, 2021, which are mostly unchanged from yesterday.

Today's mortgage rates edge up for longest and shortest terms, others unchanged | August 24, 2021

Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as "Credible" below, is to give you the tools and confidence you need to improve your finances.

Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as "Credible" below, is to give you the tools and confidence you need to improve your finances.

Biden administration cancels another $5.8B in student loan debt: Here's who qualifies

More than 323,000 federal student loan borrowers with a total and permanent disability (TPD) will have their college debt automatically discharged by the end of the year. Read on to see who qualifies, and what you should do with your debt if you're not eligible for a TPD discharge.

More than 323,000 federal student loan borrowers with a total and permanent disability (TPD) will have their college debt automatically discharged by the end of the year. Read on to see who qualifies, and what you should do with your debt if you're not eligible for a TPD discharge.

How to take out a student loan: A step-by-step guide

Start by filling out the FAFSA for federal student loans before you turn to private loans to pay for college.

Start by filling out the FAFSA for federal student loans before you turn to private loans to pay for college.

Car theft surged in 2020, report finds: Why you need auto insurance that protects against theft

Auto theft surged in 2020 amid the coronavirus pandemic. Here's what you need to know about car insurance and how it covers vehicle theft.

Auto theft surged in 2020 amid the coronavirus pandemic. Here's what you need to know about car insurance and how it covers vehicle theft.

Industrial demand fills millions of square feet of space in Houston

As the nation's economy finds footing during the COVID-19 pandemic, industrial growth has remained one of the bright spots and a new report shows Houston bit off a big chunk of that business and is chewing vigorously.

As the nation's economy finds footing during the COVID-19 pandemic, industrial growth has remained one of the bright spots and a new report shows Houston bit off a big chunk of that business and is chewing vigorously.

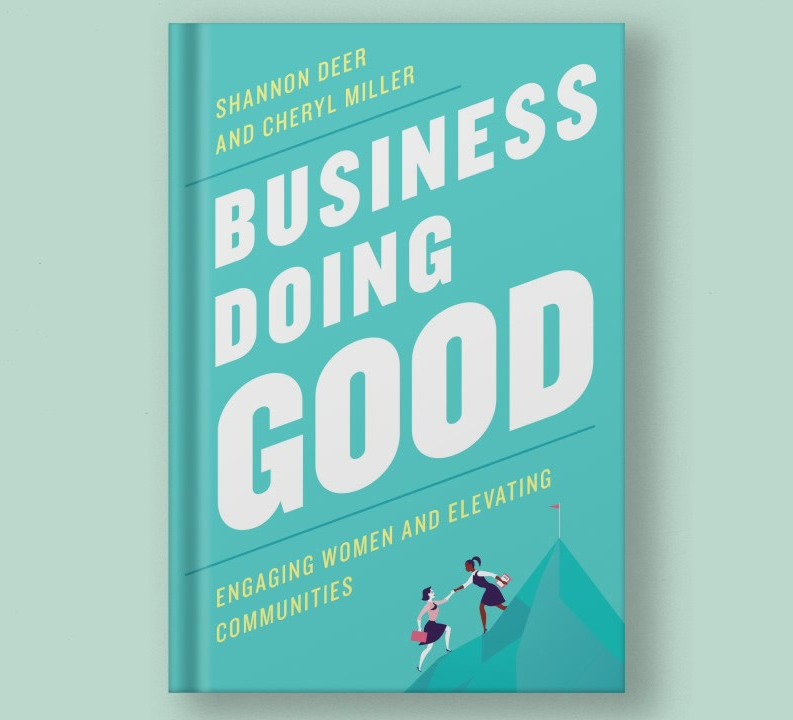

New book published to show resilience of women with troubled pasts, usefulness in business

Two local women have published a book to help businesses hire women that they call overcomers. We're talking about people who have overcome life in sex trafficking, poverty, crime, or drug addiction are tapping into special skills that these women develop.

Two local women have published a book to help businesses hire women that they call overcomers. We're talking about people who have overcome life in sex trafficking, poverty, crime, or drug addiction are tapping into special skills that these women develop.

Houston industry getting busier

As the nation's economy finds footing during the COVID-19 pandemic, industrial growth has remained one of the bright spots. However, we take a look at a new report that shows Houston bit off a big chunk of that business and is chewing vigorously.

As the nation's economy finds footing during the COVID-19 pandemic, industrial growth has remained one of the bright spots. However, we take a look at a new report that shows Houston bit off a big chunk of that business and is chewing vigorously.

Best graduate student loans of fall 2021

Federal student loan options for graduate students are limited. Private student loans could help you fill the gap and fund your graduate degree.

Federal student loan options for graduate students are limited. Private student loans could help you fill the gap and fund your graduate degree.

Are baby boomers to blame for the housing shortage? How to buy a home despite low inventory

While it's easy to point a finger at older generations who are eating up a disproportionate amount of housing inventory, baby boomers may not be to blame.

While it's easy to point a finger at older generations who are eating up a disproportionate amount of housing inventory, baby boomers may not be to blame.

How student loan debt grew to $1.6T and what can debtholders do to reduce theirs

Since 2003, the total national student loan debt surged by 602.5% to nearly $1.7 trillion, according to educationdata.org.

Since 2003, the total national student loan debt surged by 602.5% to nearly $1.7 trillion, according to educationdata.org.

20-year mortgage refinance rates end week with quarter-point dive | August 20, 2021

Check out the mortgage refinancing rates for August 20, 2021, which fell for longer terms and held for shorter ones since yesterday.

Check out the mortgage refinancing rates for August 20, 2021, which fell for longer terms and held for shorter ones since yesterday.