Texas Senate leaders celebrate passage of homestead exemption increases

Texas senators celebrate passage of homestead exemption

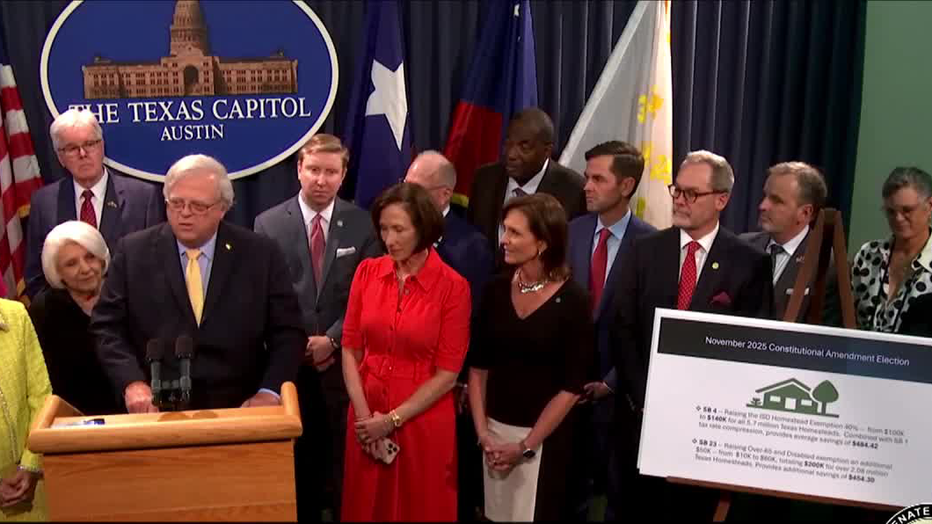

Sen. Paul Bettencourt and other members of the Texas Senate on Thursday celebrated the passage of two bills that will increase the homestead exemption for Texas homeowners. The bills will need constitutional amendments to take effect. Voters will decide on the fate of the program in November.

AUSTIN, Texas - Leaders in the Texas Senate celebrated passing both bills of property tax relief for Texans on Thursday afternoon. The fate of those tax breaks will now be in the hands of voters.

Sen. Paul Bettencourt (R- Houston), Lt. Gov. Dan Patrick and other senators spoke on the passage of Senate Bill 4 and Senate Bill 23. SB4 raises the homestead exemption for Texas homeowners to $140,000, while SB23 increases that exemption by another $60,000 for Texans over 65 and those with disabilities.

What they're saying:

"It's a fantastic day for Texas taxpayers once again," Bettencourt said. "With leadership of the Texas Senate, Texas House, and the entire legislature. We've come with two great packages for homeowners and part of a $10 billion commitment of property tax relief."

Sen. Paul Bettencourt and other Texas senators celebrate the passage of two bills that will provide larger homestead exemptions to homeowners. (Texas Senate)

Thursday's news conference included a bipartisan group of senators, including Houston Democrat Carol Alvarado, who said property tax wasn't a red or blue issue.

"Property tax relief, is that red? It isn't blue. In fact, it's green," Alvarado said. "It's green because it's going to save everyday Texans money."

She also called the tax breaks an investment in the future.

"If you aren't a senior, someday you will be," Alvarado said. "We all will be. So we're investing in our future."

Senate Bill 4

Senate Bill 4 increases the homestead exemption from $100,000 to $140,000, reducing how much a home’s value can be taxed.

School taxes are the largest portion of a property owner’s taxes.

The bill would also guarantee school districts would not lose funding as a result of the exemption.

The other side:

Critics argue that the bill only helps homeowners and would pass the tax responsibility to renters and commercial property owners.

Others argue that the bill doesn’t do enough to return money to Texans.

The bill passed unanimously in the House and Senate.

By the numbers:

Senate Bill 4 works in conjunction with Senate Bill 1, the General Appropriations Act, which provides 6.8 pennies of school district tax rate compression.

The compression will reduce the statewide average ISD tax rate from $0.9766 to $0.9086, resulting in an additional $133.13 in savings for the average homestead property owner.

Bettencourt says with the savings from SB 4, the total estimated annual tax reduction for Texas homeowners is $496.57.

Senate Bill 23

Senate Bill 23 would increase the homestead exemption for older homeowners and those with disabilities from $10,000 to $60,000.

Supporters say the bill helps provide protection to vulnerable populations that often live on a fixed income and helps them stay in their homes and neighborhoods.

"The average senior homeowner will not have to pay school taxes," Patrick said. "You've always heard that mantra, 'I don't want to rent my home after it's paid for from my school district.' Well, seniors, for the average senior out there, you're never going to have to do that again."

What's next:

Ultimately, the bills’ success will be in the hands of voters in November, who must approve of the changes since both bills involve amending the state constitution.

"You've got to get to the polls and vote in this November election for the constitutional amendment that you will have to pass for our home exemption," Sen. Donna Campbell (R-New Braunfels) said. "So you've got work ahead of you. We finished ours, and now it's up to you."

The Source: Information about Thursday's news conference comes from Lt. Gov. Dan Patrick's office. Information on Senate Bills 4 and 23 comes from the Texas Legislature and previous FOX 26 reporting.