Report: Millionaires have stopped paying into Social Security for the year, others will keep paying

HOUSTON - President Joe Biden has proposed a variety of tax increases on the nation's highest earners in his latest budget that could raise more than $5 trillion over the next decade. But, while there will be squabbling over corporate and individual tax rates, capital gains, and a so-called "billionaires tax", some of those high-earners have finished paying a tax that most Americans will face for the rest of the year.

USA Today notes a report from the left-leaning think tank Center for Economic and Policy Research, that millionaires have finished paying the 2023 Social Security FICA tax taken from their paychecks.

MORE: Powell signals increased interest rate hikes if economy stays strong

Social Security is financed by a 6.2% payroll tax paid by workers and an additional 6.2% paid by employers. In 2023, earnings are capped at $160,200 that are subject to the tax. In very basic math, someone who earns $83,333 a month ($1 million annually) finished paying into Social Security by the end of February. By contrast, CEPR notes that 94% of workers makes less than $160,200 a year, and will pay the 6.2% Social Security payroll tax on all of their paychecks.

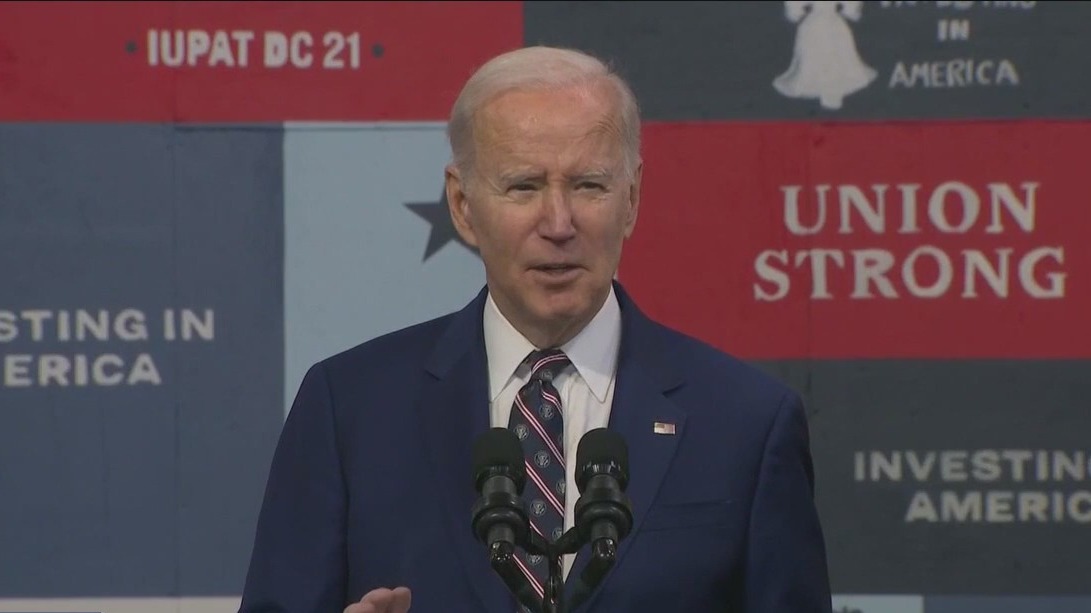

President Biden released budget

President Biden released his budget on Thursday with a price tag of nearly $7 trillion dollars. It hikes taxes on top earners and is full of Democrat priorities. FOX's Madeleine Rivera reports on what Republicans are saying about the budget.

At a time when there is a growing number of people receiving benefits, in the face of shrinking resources, there is discussion in Washington about changing Social Security eligibility or cutting benefits. According to the 2022 Social Security Trustees report, Social Security reserves are expected to be depleted in 2034.

MORE: Artificial Intelligence scammers using voices of loved ones to target victims

Raising the cap on earnings is one issue being considered. Last month, Democrats reintroduced the Social Security Expansion Act, which would lift the Social Security tax cap and subject all income above $250,000 to the tax. Supporters argue the program would be fully funded through 2096. The Act would also expand benefits and target investment income for taxation.

Supporters say it is a strategy to keep Social Security solvent, while critics say it could amount to one of the largest tax-hikes ever levied.