Where to get a $5K loan

Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as "Credible" below, is to give you the tools and confidence you need to improve your finances. Although we do promote products from our partner lenders, all opinions are our own.

Many lenders offer $5K loans — personal loans with a fixed rate that you repay over time. Learn where to get a $5K loan. (iStock)

If you need to borrow cash to cover home improvement projects, medical bills, debt consolidation, or an unexpected expense, personal loans are a popular choice. Many people look to personal loans when they want to fund a large expense because they typically come with lower interest rates than other financial products, like credit cards.

Here’s where to get a $5K personal loan and how to qualify for one.

- Where to get a $5K loan

- How much will a $5K loan cost?

- How can I qualify for a $5,000 loan?

- Getting a $5,000 loan with fair or bad credit

- Personal loan FAQs

Where to get a $5K loan

Borrowing $5,000 is fairly common, so you likely won’t have any problems finding a lender who offers loans in this amount. Interest rates, terms, and fees can vary widely depending on where you get a $5,000 loan, so it’s important to shop around and compare lenders. Comparing lenders is the best way to ensure you’re getting the best rate and loan terms for your situation.

Online lenders

Online lenders are convenient because they typically allow you to complete the entire borrowing process online, from application to funding. They also often offer quick funding — typically within a business day or two of approval. Interest rates tend to be lower with online lenders since they don’t have the costs associated with physical branches.

Banks and credit unions

If you have an existing relationship with a traditional bank that offers personal loans (not all do), you may be able to get a better deal on your interest rate. You may also find better rates and terms with a credit union, since they’re not-for-profit organizations. But you’ll need to either be a member of the credit union, or meet the qualifications for becoming a member.

You can compare personal loan rates from various lenders with Credible, and it won’t affect your credit score.

How much will a $5,000 loan cost?

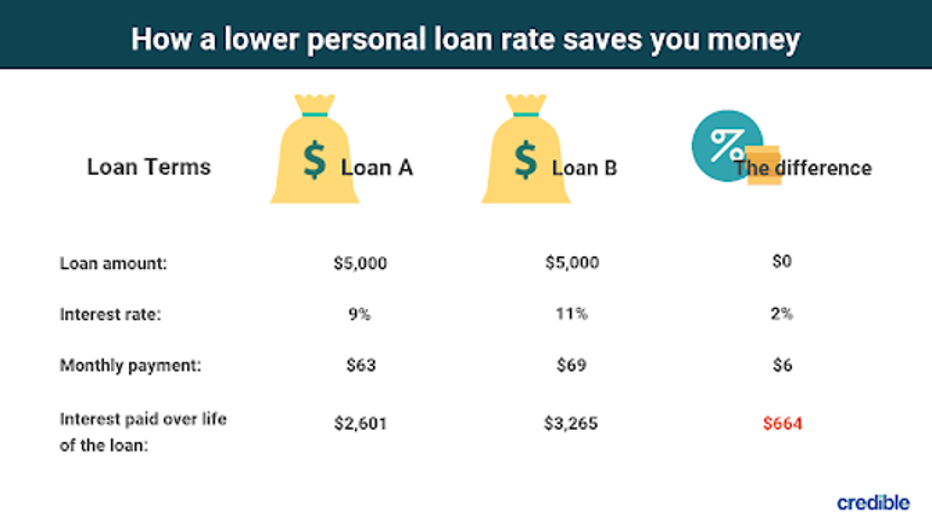

How much a $5,000 loan costs depends on the interest rate and repayment terms. The following two examples illustrate what a $5,000 loan could potentially cost.

Let’s say Lender A offers you a $5,000 loan at 9% interest paid back over 10 years. With this loan, you’d pay $63 monthly for a total of $2,601 in interest over the life of the loan.

Lender B offers a slightly higher rate of 11% on the same amount for the same loan term. With this loan, your monthly payment would be $69 and you’d pay a total of $3,265 in interest over the life of the loan — $664 more than the first example. You can see that even an interest rate difference of one or two percentage points can make your loan more expensive.

When it only takes a few minutes to rate shop online, it makes sense to see what different lenders can offer. You can also use a personal loan calculator to get a sense of what your monthly payments on a $5K loan might be.

How can I qualify for a $5K loan?

How much a $5,000 loan costs depends on the interest rate and repayment terms. The following two examples illustrate what a $5,000 loan could potentially cost.

Let’s say Lender A offers you a $5,000 loan at 9% interest paid back over 10 years. With this loan, you’d pay $63 monthly for a total of $2,601 in interest over the life of the loan.

Lender B offers a slightly higher rate of 11% on the same amount for the same loan term. With this loan, your monthly payment would be $69 and you’d pay a total of $3,265 in interest over the life of the loan — $664 more than the first example. You can see that even an interest rate difference of one or two percentage points can make your loan more expensive.

When it only takes a few minutes to rate shop online, it makes sense to see what different lenders can offer. You can also use a personal loan calculator to get a sense of what your monthly payments on a $5K loan might be.

Getting a $5,000 loan with fair or bad credit

If you have bad credit or little or no credit history, don’t fear — some lenders offer loans specifically for people with bad credit. These loans do come with higher interest rates than loans for borrowers with good credit, though. So if you can wait to borrow money, it may make sense to work on raising your credit score before you apply for a $5,000 loan.

Another way to get the lowest rates on a loan is to add a cosigner with good or excellent credit. Having a cosigner eases some credit "risk" to lenders and saves you money in the long run.

Personal loan FAQs

What is a personal loan?

A personal loan is a fixed-rate installment loan offered by banks, credit unions, and online lenders. Many personal loans are unsecured, meaning you don’t have to put down any collateral in order to receive the loan. You repay whatever amount you borrow, plus interest, in fixed amounts over a set period of time (typically 12 to 48 months).

What is the monthly payment on a personal loan?

Each personal loan has a predetermined monthly payment amount, which depends on how much you borrow, the interest rate, and the length of your repayment term. You can use a personal loan calculator to estimate your monthly payment based on the amount you want to borrow and the interest rate.

What are personal loan fees? Fees

Many loans come with fees. Some common fees you’ll see when taking out a personal loan include an origination fee for disbursing the loan, late payment fees, and a prepayment penalty fee for paying off your loan early.

What are personal loan repayment terms?

Depending on your individual financial situation, you’ll want to look at repayment terms closely. For example, a shorter loan term, like a three-year term, would have a lower interest rate but higher monthly payment. If you wanted a lower monthly payment in order to keep your budget more flexible, you could opt for a lengthier loan term, like seven years. Typically, the longer the loan term, the higher the interest rate.

What is personal loan principal and interest?

The principal is the total loan amount you take out, but this isn’t the total amount you pay on the loan because it doesn’t include interest.

The total interest is the total amount of interest you’ll pay to the lender for borrowing money. This is different from the annual percentage rate, which is the total cost of borrowing money, including both interest and fees. When comparing lenders, look at the APR to get a more accurate picture of how much a loan will cost.

To see what rates you may qualify for, use Credible to compare personal loan rates from various lenders.