Drivers in this state will receive a $400 car insurance refund check

Recent bipartisan car insurance reform in Michigan will result in refund checks being delivered directly to drivers' pockets. (iStock)

Eligible Michigan drivers will receive a $400 car insurance refund per vehicle this spring due to a surplus held by the Michigan Catastrophic Claims Association (MCCA).

"The $400 per-vehicle refund is a result of the reforms passed with bipartisan support by the Legislature and signed into law by Gov. Gretchen Whitmer, as well as sound financial returns on investments made by the MCCA," according to a press release.

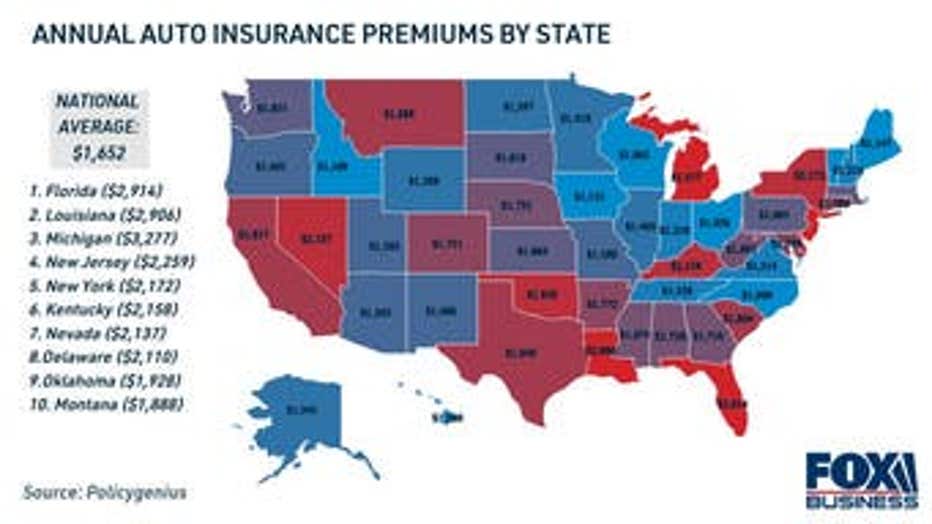

Still, Michigan has the third-highest auto insurance rates in the country after Florida and Louisiana, according to Policygenius data. Drivers paid an average of $2,377 per year in car insurance premiums, well above the national average of $1,652.

Keep reading to learn more about these car insurance refunds. And if you're interested in switching your car insurance, you can visit Credible to shop around for the right policy for your needs.

CAR ACCIDENTS SPIKED NEARLY 8% IN 2020, SAYS DOT

Who will get an auto insurance refund and when?

Michiganders who had car insurance as of Oct. 31, 2021, will begin to receive $400 refund checks from their auto insurance company starting in the second quarter of 2022, according to the state's insurance department. In total, Michigan drivers will receive an estimated $3 billion worth of car insurance refunds.

The MCCA's decision to refund surplus money to drivers is due to auto insurance law reform by Michigan's legislature in 2019. This reduced the minimum insurance requirements for personal injury protection medical coverage.

"Michiganders have paid into the catastrophic care fund for decades, and I am pleased that the MCCA developed this plan so quickly after unanimously approving my request to return surplus funds to the pockets of Michiganders," Gov. Whitmer said in a statement to NPR.

Eligible drivers don't need to take any action to get the payout. The state said the MCCA will send the funding to car insurance companies in early March, and the money must be sent to drivers within 60 days.

The MCCA recommended that Michigan motorists who believe they meet the eligibility requirements for a refund should get in touch with their auto insurance agent for more information about their refund timeline and status. If you don't qualify for a refund, you could consider other methods for saving money on your auto insurance policy.

One strategy is to compare quotes across multiple car insurance companies to ensure you're getting a competitive rate. You can visit Credible to get free auto insurance quotes.

IF YOU'RE BUYING AN RV, HERE'S WHAT YOU NEED TO KNOW

How to reduce the cost of insurance

Even with the refund, Michigan policyholders pay some of the highest auto insurance rates in the country. Michigan is just one of 8 states where drivers pay more than $2,000 annually for car insurance, joined by Florida, Louisiana, New Jersey, New York, Kentucky, Nevada and Delaware, according to Policygenius data.

Overpaying for auto insurance can take funds from your monthly budget that can be used to cover other necessary expenses, like groceries or utility bills. If you're looking for ways to save money on car insurance, consider the following strategies from the Insurance Information Institute (III):

- Raise the deductible. A higher deductible will lower your monthly premium, but it will cost you more out of pocket if you have to file a claim.

- Bundle insurance policies. Insurance companies that offer auto and home insurance, for example, may offer a multi-policy discount.

- Look for other discounts. You may qualify for a discount for safe driving, low mileage and even good grades for students. Taking a defensive driving course may also lower your monthly rate.

- Maintain good credit. Drivers with a well-established credit history may benefit from lower car insurance costs.

- Shop around across insurers. Car insurance premiums vary from one company to another, so it's good to get at least three quotes from different insurers.

It's possible to compare quotes across multiple auto insurers at once on Credible. Visit the online financial marketplace to learn more about car insurance and see if you can lower your costs.

BIDEN CRITICIZES REPUBLICANS FOR 'DANGEROUS' DEBT CEILING INACTION

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.