Mortgage refinancing is cheaper than ever today with sub-3% rates, no adverse market fee

Homeowners can save more than ever before when refinancing, thanks to the early conclusion of the Adverse Market Refinance Fee. (iStock)

It just got even cheaper to refinance a mortgage, thanks to historically low interest rates and the elimination of a 0.5% refinancing fee for lenders.

Now that lenders don't have to pay the Adverse Market Refinance Fee, they can pass on the cost savings to borrowers. The Enterprises (Fannie Mae and Freddie Mac) got rid of this fee earlier than expected, so that borrowers have the opportunity to take advantage of interest rates while they're still near record lows.

The window of opportunity for scoring a dirt-cheap mortgage refinance won't stay open forever, though. Mortgage interest rates are expected to rise by the end of 2021, and they may approach 5% by 2023, according to some estimates.

Don't miss out on the chance to get a sub-3% mortgage refinance rate. You can compare refinancing offers across multiple lenders without impacting your credit score on Credible.

BIDEN ADMINISTRATION JUST MADE IT CHEAPER TO REFINANCE YOUR MORTGAGE

Eliminating the Adverse Market Refinance Fee makes refinancing cheaper than before

The Federal Housing Finance Agency (FHFA) implemented the Adverse Market Refinance Fee in December 2020 in order to cover losses as a result of the COVID-19 pandemic. But with a stable economic recovery and a low percentage of borrowers still in COVID-19 forbearance, the FHFA was able to eliminate this fee earlier than expected to "help families reduce their housing costs," according to a statement.

Effective Aug. 1, 2021, lenders will no longer be required to pay this fee, and the FHFA expects lenders to pass the cost savings back to borrowers.

Although the Adverse Market Refinance Fee won't technically be eliminated for a few more weeks, mortgage lenders are able to adjust their rates starting today. That's because loans that are originated now won't close until after August 1.

This means borrowers can start taking advantage of low-cost mortgage refinancing immediately. To start saving money on your housing costs, visit Credible to lock in your sub-3% mortgage refinance rate.

HERE’S HOW COVID-19 CHANGED THE MORTGAGE INDUSTRY

Mortgage rates are low now, but they're predicted to rise soon

By refinancing your home loan to a lower rate, you can potentially lower your monthly mortgage payment, pay off your debt faster and save money over the life of your home loan.

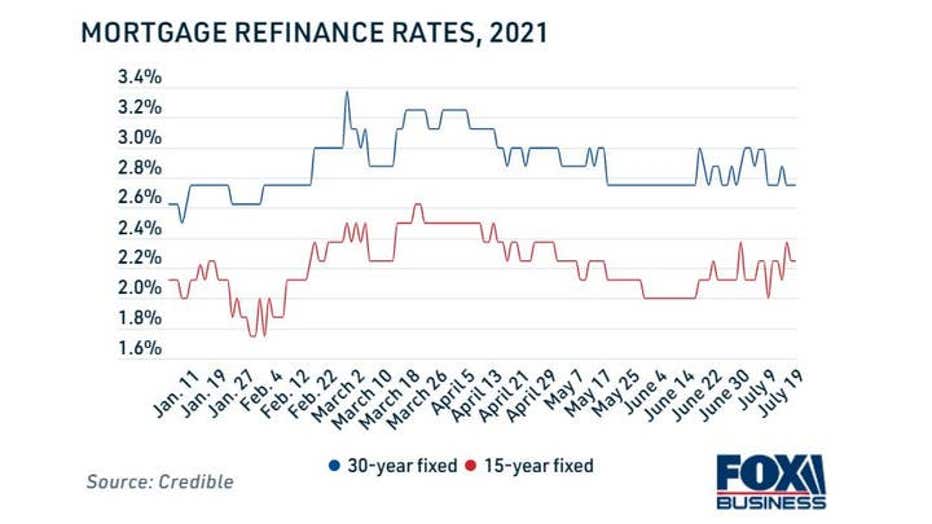

For the past few months, 30-year rates have been hovering at or below 3%, according to data from Credible. Here are the most current mortgage rates available, as of July 19:

- 30-year refinance rate: 2.750%

- 20-year refinance rate: 2.750%

- 15-year refinance rate: 2.250%

- 10-year refinance rate: 2.000%

But mortgage rates fluctuate over time, and today's rates won't last forever. That's because mortgage interest rates are impacted by demand, as well as the Federal Reserve's interest rate on the 10-year Treasury Yield.

The Fed predicts two rate hikes by 2023, and these rate hikes will cause mortgage rates to increase. The Mortgage Bankers Association (MBA) forecasts 30-year rates will rise to 4.2% in 2022 and 4.9% in 2023.

While the future of mortgage rates can be difficult to predict, it's likely that interest rates will rise sooner rather than later. It's more important than ever to act fast if you want to snag a record-low rate on your refinance.

The table below shows mortgage rates from real lenders. To see estimated interest rate offers tailored to your financial situation, get preapproved on Credible.

VETERANS BORROWING VA LOANS AT A RECORD PACE, STUDY SHOWS

Don't wait to begin the refinancing process

If you haven't yet refinanced your home loan, the time to do so is now. By refinancing to a lower interest rate, you can save money on your mortgage payments and reduce the amount of interest you pay on your home loan over time.

The mortgage refinancing process is simple, but you don't have to do it alone. Get in touch with a knowledgeable loan expert on Credible who can answer any questions you have and guide you while you refinance your home loan.

WHAT ARE THE NEW FHA LOAN LIMITS FOR 2021?

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.