Nearly 70% of medical debt in collections will be removed from credit reports, bureaus say

The major credit bureaus have updated their rules for sending medical bills to collections, which is expected to remove nearly 70% of medical collections debt from credit reports. (iStock)

Medical debt is a costly burden that weighs on millions of patients who seek life-saving care — it's the leading cause of bankruptcy in America and the largest source of personal debt among consumers.

In an effort to support those who are faced with unexpected hospital bills, Equifax, Experian and TransUnion will soon remove nearly 70% of medical debt in collections from credit reports.

"Medical collections debt often arises from unforeseen medical circumstances," credit bureau executives said in a joint statement. "These changes are another step we’re taking together to help people across the United States focus on their financial and personal wellbeing."

Keep reading to learn more about the agencies' new policy around medical debt reporting, as well as how to pay off unpaid hospital bills in collections. You can also enroll in free Experian credit monitoring services through Credible.

CREDIT CARD CONSOLIDATION MAY SAVE YOU THOUSANDS AS PERSONAL LOAN RATES ARE AT RECORD LOWS

Removing medical debt from reporting may boost consumer credit scores

Beginning in July, paid medical debt in collections will no longer be included in credit reporting. And in the first half of 2023, the credit bureaus will no longer include medical collections debt under $500 on credit reports.

The agencies are also increasing the time period before unpaid medical bills would appear on a consumers' credit history to one year, up from six months previously. They anticipate the combined measures will remove nearly 70% of existing medical debt tradelines.

The decision came shortly after the Consumer Financial Protection Bureau (CFPB) released a report finding that unpaid medical bills account for 58% of debt in collections.

"Even when a patient tries to battle to get an accurate bill or an insurance claim paid, medical debt collectors have a weapon that is hard to fight against: the credit report," CFPB Director Rohit Chopra said.

While the credit bureaus have effectively dropped many types of medical bills from credit reporting, millions of consumers are still faced with debt in collections. If these bills remain unpaid, they could potentially result in negative credit score impacts after a one-year period. Third-party debt collectors may eventually pursue civil action to recuperate the costs, which can result in wage garnishment and attorney fees.

HOW YOUR STUDENT LOANS COULD BE IMPACTED BY THE FED RATE HIKE

How to pay off medical debt in collections

Although some medical collections debt will soon be dropped from credit reporting, consumers still owe the balance of their unpaid bills from prior health care services. Here are a few strategies for repaying medical debt in collections:

- Negotiate your medical bills with the provider or debt collector

- Utilize a medical financing card or 0% APR credit card

- Consolidate medical debts into a fixed-rate personal loan

Read more about each method in the sections below.

Negotiate your medical bills with the provider or debt collector

Patients may be able to settle their medical bills for less than they owe by negotiating with the collection agency that holds the debt. It may also be possible to enroll in an interest-free payment plan to spread your hospital bills into lower monthly installments. Here are a few negotiation tips from the CFPB:

- Ask the debt collector for a written notice about the origin of the debt and how much money is owed. You should also know the age of the debt, so you can see if it meets your state's statute of limitations.

- Propose a realistic debt settlement or repayment proposal. Calculate how much you can afford to pay each month, or see if you have enough money to settle the debt in a smaller lump-sum.

- Be honest about your situation, as you may have more room to ask for a discount if you have a long-term health condition or other financial burden. Take notes of your conversation with the creditor.

You can use a cost comparison tool like Healthcare Bluebook to research the average price of the service you received in your area, which may be used as leverage while you negotiate the balance in your collection account. And if you aren't confident in your own negotiation skills, you may consider enlisting the help of a nonprofit credit counselor to speak with your creditors on your behalf.

CREDIT CARD DEBT IS SURGING AT A RECORD-HIGH RATE, NY FED REPORTS

Utilize a medical financing card or 0% APR credit card

Some medical providers offer low-interest and no-interest financing options through a medical credit card like CareCredit. Keep in mind that these payment plans are typically offered through the original health care provider, not debt collectors. They also typically come with a high purchase APR if you don't adhere to the payment agreement.

Alternatively, you could consider opening a new credit card with a 0% APR purchase period. This may allow you to repay your medical expenses without paying interest for a period of up to 21 months. It's important to note that these offers are generally reserved for applicants with very good or excellent credit, defined by the FICO model as 740 or higher.

You can visit Credible to compare credit cards with 0% APR introductory offers.

LOOKING FOR A LIFE INSURANCE AGENT? HOW TO CHOOSE THE RIGHT ONE

Consolidate medical debts into a fixed-rate personal loan

One common way to repay debt is with an unsecured personal loan that you repay in fixed monthly payments over a set period of months or years. Since personal loans have fixed interest rates, they may offer more favorable repayment terms than variable-rate credit cards.

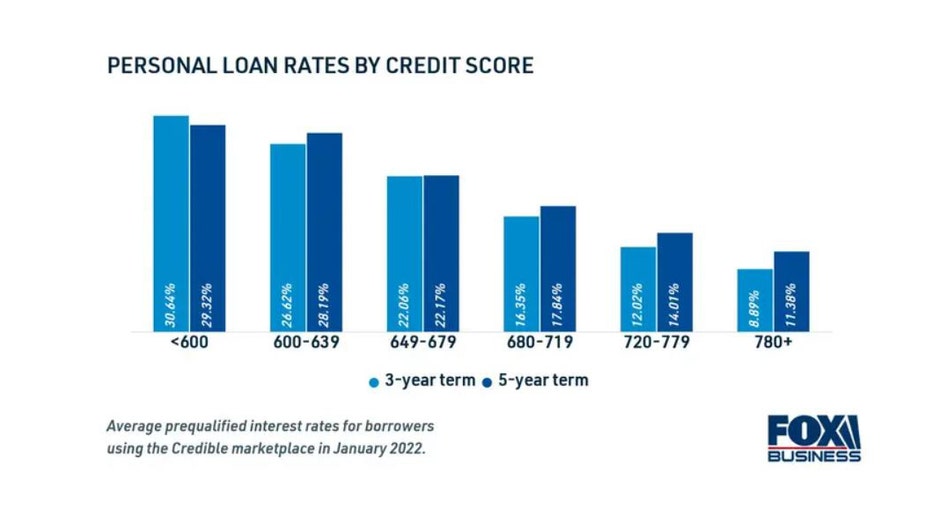

Personal loan lenders determine interest rates and eligibility based on a borrower's credit score. Applicants with excellent credit will qualify for the lowest rates possible, while those with bad credit may not be eligible at all.

To see if you're a good candidate, you can get prequalified for a debt consolidation loan with a soft credit check. You can also browse current interest rates in the table below, and use Credible's personal loan calculator to estimate your monthly payments.

REFINANCING REQUIREMENTS FOR A MORTGAGE: WHAT TO KNOW

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.