Financial infidelity? Over 40% of US adults say they've kept money secrets

Would you consider it cheating if your romantic partner hid a debt, a credit card or other financial secret from you? Over 40% of US adults admitted to keeping money secrets.

Would you consider it cheating if your romantic partner hid a debt, a credit card or other financial secret from you? Over 40% of US adults admitted to keeping money secrets.

Tax season: Bigger paycheck or tax refund better?

Millions of Americans eagerly await their refund check every tax season and while it can be a big payday, some experts say a huge check isn't always a good thing. Mark Steber, the Chief Tax Information Officer at Jackson Hewitt explains.

Millions of Americans eagerly await their refund check every tax season and while it can be a big payday, some experts say a huge check isn't always a good thing. Mark Steber, the Chief Tax Information Officer at Jackson Hewitt explains.

Dating app requires users to have credit score of 675 or above to join

The dating app is only "for people with good credit," the company says. Users can't see others' scores, but the information is used to qualify a potential user for the app.

The dating app is only "for people with good credit," the company says. Users can't see others' scores, but the information is used to qualify a potential user for the app.

Inflation pushes household spending

Financial markets had a significant selloff after the government reported January inflation was higher than expected. FOX 26 Business Reporter Tom Zizka says for customers, the news is something many already know.

Financial markets had a significant selloff after the government reported January inflation was higher than expected. FOX 26 Business Reporter Tom Zizka says for customers, the news is something many already know.

Millennials are desperate to buy a home, most willing to pay a mortgage rate above 7 percent: survey

Affordability challenges aside, 78% of millennial respondents in a recent Real Estate Witch survey still believe in the dream of homeownership.

Affordability challenges aside, 78% of millennial respondents in a recent Real Estate Witch survey still believe in the dream of homeownership.

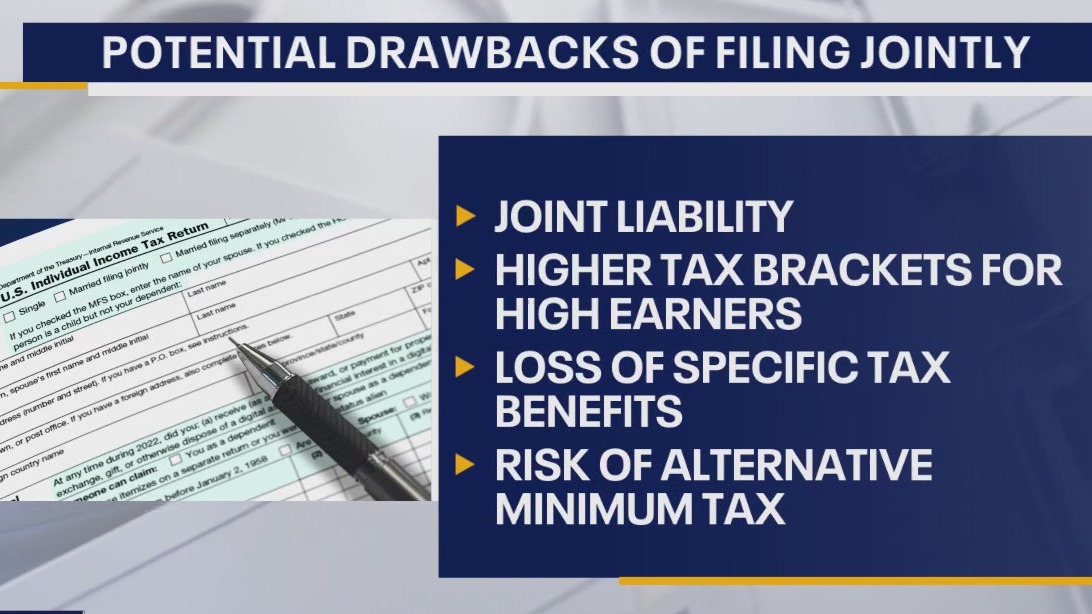

2024 tax season: Filing jointly vs. separately

Married couples have some big decisions to make this tax season, whether to file together or decide to file separately. Rebekah Howard, owner of Howard Certified Public Accountants breaks down the pros and cons of each.

Married couples have some big decisions to make this tax season, whether to file together or decide to file separately. Rebekah Howard, owner of Howard Certified Public Accountants breaks down the pros and cons of each.

U.S. raises are trending down this year as the job market cools

Employers are planning to raise wages by 4%, on average this year, higher than 2021, but lower than 2023.

Employers are planning to raise wages by 4%, on average this year, higher than 2021, but lower than 2023.

Missed student loan payments set to affect credit scores again by the end of 2024: Here’s how to prepare

Borrowers who miss student loan payments will see repercussions again by September, thankfully there are forgiveness options.

Borrowers who miss student loan payments will see repercussions again by September, thankfully there are forgiveness options.

Gas and oil prices are on the rise as warm weather brings more demand

Gas prices are up from last month, but down $0.29 compared to last year.

Gas prices are up from last month, but down $0.29 compared to last year.

House passes $78 billion tax bill expanding the child tax credit, its fate in the Senate remains to be seen

The child tax deduction expansion would make more of the credit refundable, helping millions of families.

The child tax deduction expansion would make more of the credit refundable, helping millions of families.

Turn your old jewelry into new cash

Your old jewelry could be worth a lot of money.

Your old jewelry could be worth a lot of money.

Most parents of adult kids are giving them financial help, study shows

“Among parents who say they helped their children financially in the past year, 36% say doing so has hurt their personal financial situation at least some," Pew writes.

“Among parents who say they helped their children financially in the past year, 36% say doing so has hurt their personal financial situation at least some," Pew writes.

Your tax refund could be bigger this year – here's why

Americans might get a fatter tax refund this year. Here's why.

Americans might get a fatter tax refund this year. Here's why.

Super Bowl 58 commercials released before the big game

Some people tune in to the Super Bowl just for the commercials but some have been released before the big game.

Some people tune in to the Super Bowl just for the commercials but some have been released before the big game.

How attacks in the Red Sea are cramping global trade; what it means for retailers

The cost to ship a standard 40-foot container from China to northern Europe has jumped from $1,500 to $4,000, according to the Kiel Institute for the World Economy in Germany.

The cost to ship a standard 40-foot container from China to northern Europe has jumped from $1,500 to $4,000, according to the Kiel Institute for the World Economy in Germany.

This is the #1 city for first-time homebuyers, and other hot US housing markets

After Toledo, Rochester, NY, Springfield, MA and Worcester all rank as some of the more affordable metro areas, particularly for first-time buyers.

After Toledo, Rochester, NY, Springfield, MA and Worcester all rank as some of the more affordable metro areas, particularly for first-time buyers.

Beware of Super Bowl betting scams

Cybersecurity experts warn fans to watch out for sports betting scams with the Super Bowl around the corner.

Cybersecurity experts warn fans to watch out for sports betting scams with the Super Bowl around the corner.

FAFSA inflation fix scheduled for mid-March, delays award notification until spring

The Department of Education said an inflation fix to FAFSA won’t come until mid-March, further delaying financial aid award notifications.

The Department of Education said an inflation fix to FAFSA won’t come until mid-March, further delaying financial aid award notifications.

12 states qualify for the IRS Direct File pilot program: Is yours one of them?

On top of a new IRS tax filing system, an adjustment to the child tax credit may qualify families for higher credits.

On top of a new IRS tax filing system, an adjustment to the child tax credit may qualify families for higher credits.

Social inflation causing insurance rates to jump, no end in sight for rising premiums in 2024

Insurance rates are rising for customers as insurers struggle to deal with claim payouts.

Insurance rates are rising for customers as insurers struggle to deal with claim payouts.