Teachers can now deduct $250 in PPE costs in classroom

Teachers get PPE tax deductions

The IRS is letting teachers get a PPE tax deduction of up to $250. Many teachers are saying it's not enough.

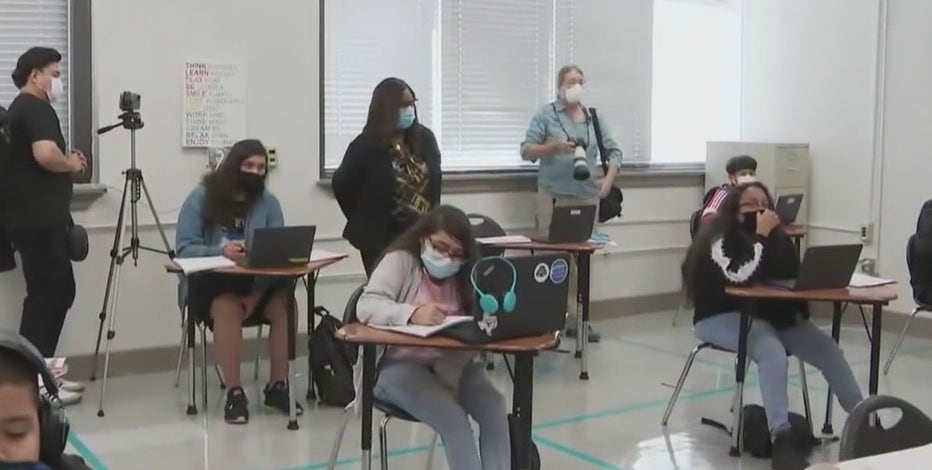

HOUSTON - Teachers will now get a tax deduction for some out-of-pocket expenses for PPE and COVID-19 protective gear they bought for their classrooms. While some say it's a relief, others say it's not nearly what they've had to spend.

Many teachers say they've had to use their own money to buy things like masks for students who don't have one, wipes to clean desks, or plastic barriers. That adds up.

Now the IRS is announcing the COVID relief bill Congress passed in December will let them deduct up to $250 of these costs on their federal tax returns.

"I have this desk I'm sitting at and over there I have the grading desk. Can you kind of see the shields I have?" said Spring Branch ISD teacher Lauren Shelley, showing us her classroom over a Zoom call.

The high school English teacher showed us plexiglass barriers, PPE, and even a monitor, webcam, and microphone she says she paid for to be able to teach her students both in-person and virtually.

"A thousand dollars, easily, easily," said Shelley of how much she spent.

Featured

Deer Park ISD accused of not enforcing masks, social distancing

Deer Park ISD mom seeks legal action over COVID-19 measures at daughter's school, where, she says, masks and social distancing were not strictly enforced.

"Virtually nothing has been provided to us. Everything we have we had to buy. A little bit of it has been reimbursed, but the stuff that's been reimbursed has been reimbursed by the PTA, not by the actual school," said Shelley.

The IRS says K-12 teachers, aides, counselors, and principals in a school for at least 900 hours during a school year can write off up to $250 in COVID protective equipment.

"It's definitely been an issue. It seems to have gotten somewhat better in many of our schools recently, but they certainly, earlier in the year, spent a significant amount of money out of their own pocket," said Zeph Capo, President of the Texas American Federation of Teachers.

Approved items include masks, disinfectants, soap, sanitizer, gloves, tape, paint, or chalk used for guidance on social distancing, barriers, air purifiers, and related videos.

Featured

Houston parents weigh in after CDC says vaccines not necessary for return to classroom

Houston parents are reacting to a new recommendation from the CDC that schools can return to in person learning without vaccinations.

"It's a welcome return. As a matter of fact, before COVID, we used to be able to deduct up to $250 of our school supplies that weren't reimbursed by the district," said Capo.

The IRS says that teachers can also include school supplies in the $250 total this year, but some teachers say it's just simply not enough.

"To cover the materials that teachers normally buy for their classrooms that they spend out of pocket, teachers, on average, spend about $1000 a year," said Capo.

"I'm pleased they're doing that for us at all, which is good, but I think it's really an indictment of the school system," reacted Shelley.

To claim the deduction, teachers can put their total expenditures up to $250 on Schedule 1, Line 10 on IRS Form 1040.