Revolving credit balances grew by 11.4% in May, Fed finds: How to pay off your credit cards

Revolving credit debt increased 11.4 percent in May, according to the Fed's latest report. Credit card borrowers with high balances and monthly bills could consider paying off debt with one of these methods. (iStock)

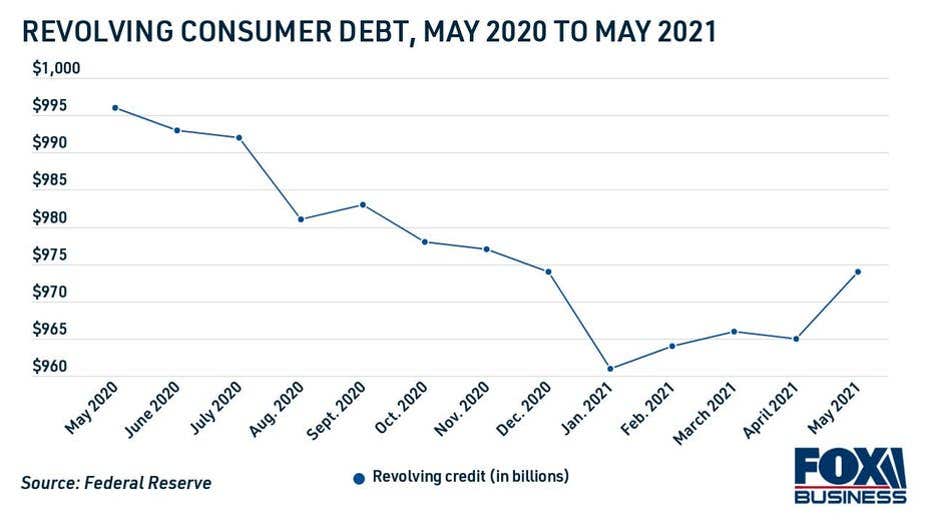

The coronavirus pandemic kept many Americans quarantined at home throughout 2020, sheltered away from high-cost activities like dining out and traveling. In addition to spending less, some consumers were able to pocket the extra money from federal stimulus checks, loan forbearances and expanded unemployment benefits. As a result, they paid down billions of dollars in credit debt last year.

But it looks like that trend may be reversing, now that the economy is revving back to its pre-pandemic state. Consumer credit increased by 10% between April and May of 2021, with revolving balances increasing by 11.4%, according to the Federal Reserve. This suggests that as Americans return back to restaurants, airports and hotels, they're putting these discretionary expenses on their credit cards.

9 OF THE BEST DEBT CONSOLIDATION COMPANIES

Revolving credit card debt is typically assessed interest, which is bad news for consumers who make the minimum payment since credit card interest rates are also rising. Between Q1 and Q2 2021, the average credit card rate on interest-bearing accounts rose from 15.91% to 16.3%, according to the Fed.

It may be tempting to resume pre-pandemic spending habits, but it's important to regulate your spending so you're not left with high-interest credit card debt. And if you're like many other Americans who have racked up a credit card balance over the past few months, now is the time to pay off debt before it spirals out of control.

There are several ways to pay off credit card debt, from personal loans to balance transfers. You can compare interest rates on a variety of financial products on Credible to make sure you're saving the most money possible while paying off debt.

HOW CREDIT COUNSELING PROGRAMS CAN HELP PAY OFF YOUR LOANS

3 ways to consolidate credit card debt

Credit card consolidation can help you save money in interest and pay off your debt faster. You'll also simplify the debt payoff process by combining all of your credit card balances into one form of financing with a single monthly payment. There are three main ways to do this:

- Personal loan

- Balance transfer

- Secured loan

Compare your options in the sections below, and visit Credible when you're ready to start consolidating credit card debt.

DEBT SNOWBALL METHOD VS. DEBT AVALANCHE: WHAT’S THE DIFFERENCE?

1. Personal loan

You can use a personal loan for just about anything, from financing home improvements to paying off medical bills. But by far, the most common use for a personal loan is to pay off credit card debt. Here are a few things you should know about personal loans.

- They're unsecured, which means they don't require collateral. Lenders will rely on your credit history and debt-to-income ratio to determine eligibility and set your interest rates.

- They're issued in a lump sum, typically directly into your bank account within a few days of approval.

- They're repaid in consistent monthly payments over a set period of months or years, so you always know how much you owe and how long you have until your debt is paid off.

Most importantly, personal loan rates are usually lower than credit card interest rates. The average rate on a two-year personal loan was 9.58% in May 2021, compared with 16.3% for credit cards assessed interest. By securing a lower rate on a personal loan than you're currently paying on your credit card debt, you can save hundreds of dollars in interest and get on the path to becoming debt-free.

If you decide to use a personal loan for debt consolidation, you should compare interest rates across multiple lenders to ensure you're getting the lowest rate for your financial situation. Visit Credible to see personal loan offers tailored to you, all without affecting your credit score.

HOW TO GET A DEBT CONSOLIDATION LOAN WITH BAD CREDIT

2. Balance transfer

Another common way to consolidate credit cards is to utilize a balance transfer. This involves transferring your credit card balances onto a new credit card with a lower interest rate.

Balance transfers can be particularly advantageous if you can qualify for a balance transfer card with a 0% APR introductory period. Some credit card companies will offer 0% APR periods for the first several months after you open an account, typically up to 18 months. This may give you enough time to pay off your credit card debt without ever accruing interest.

This debt consolidation method isn't right for everyone, though. To qualify for the best offers, you'll need a good or better credit score — defined as a score of 670 or higher using the FICO model. Plus, you may have to pay a balance transfer fee, which is usually 3-5% of the amount being transferred. And be aware of credit card balance transfer limits, since you may owe more debt than you're able to transfer.

Find the right credit card issuer for your needs on Credible.

CASH-OUT REFINANCE VS. HOME EQUITY LOANS: WHICH TO PICK

3. Secured loan

If you have fair or bad credit and you can't qualify for a personal loan or balance transfer card, consider paying off your credit card debt with a secured loan instead.

Secured loans require collateral, so it's less of a risk for the lender. The biggest drawback, though, is that the lender can seize the asset you used as collateral if you don't repay the loan. That being said, there are a few types of secured loans to consider when paying off credit card debt:

- 401(k) loan: Certain retirement plans allow you to borrow a low-interest loan from the money you've invested in your retirement account. Since you're borrowing from yourself and not a lender, you don't have to go through a credit check, and you're paying interest back to yourself. 401(k) loans are limited to $50,000 or half the vested amount in your retirement account, whichever is less.

- Secured personal loan: Select lenders offer loans that are secured by the value of your vehicle. These are a good option if you need a personal loan for bad credit but you don't want to pay extremely high interest rates, but they can be risky since you'll lose access to transportation if you don't repay the loan.

- Cash-out mortgage refinancing: With high home equity and low mortgage rates, now is a good time for homeowners to refinance. When you choose the cash-out mortgage refinance option, you'll take out a loan that's larger than your current home loan and use the extra money to pay off credit card balances.

It's always critical to compare interest rates when taking out a financial product, and that's especially true when it comes to mortgage refinancing. Mortgage rates are historically low, so there's never been a better time to refinance. See what kind of rates you qualify for on Credible.

WITH STUDENT LOAN REFI RATES NEAR RECORD LOWS, HERE'S HOW TO CALCULATE YOUR SAVINGS

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.