Mortgage refinancing can save you nearly $100K in interest: Here's how

With today's mortgage rates near record lows, it's a good time to refinance your mortgage. Doing so can lower your monthly payment and save you tens of thousands of dollars in interest over the life of your home loan. (iStock)

If you haven't refinanced your mortgage yet, you could be missing out on significant cost savings.

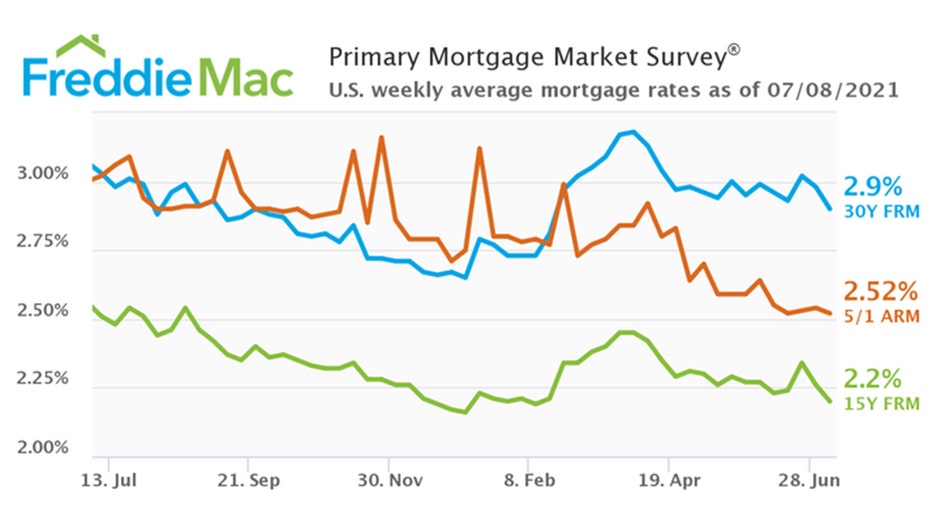

Mortgage rates have dipped below 3% again on a 30-year term, and they're near historic lows for a 15-year term, according to Freddie Mac.

Thanks to these low interest rates, homeowners may be able to save money on their monthly payments and even pay off their home loans faster by refinancing. But historically low mortgage rates can't last forever, and experts believe rates will rise significantly, as the Federal Reserve predicts two rate hikes by 2023.

Mortgage refinancing is an easy process, and the fees are low compared to the cost savings. See how much refinancing can save you in the analysis below, and visit Credible when you're ready to lock in your mortgage refinancing rate.

DOES REFINANCING YOUR MORTGAGE LOWER YOUR CREDIT SCORE?

How much money can you save by refinancing?

Let's say you bought a home for $312,500 in July 2013, borrowing a 30-year, fixed-rate mortgage worth $250,000 after a 20% down payment. At that time, mortgage rates were around 4.5%, so your monthly payment is $1,267.

Now, eight years into your home loan, the current loan balance on your mortgage is $212,043. You've paid $83,647 in interest so far, but if you keep these loan terms and never refinance, you'll pay $206,017 worth of interest over the life of your mortgage.

Tip: You can use a mortgage amortization calculator to see how much interest you've paid on your mortgage and calculate the remaining balance.

MORTGAGE LOAN ORIGINATION FEES: WHAT ARE THEY AND HOW TO AVOID THEM

Option 1: Refinance to a 15-year mortgage to pay off your mortgage faster

Many homeowners choose to refinance to a shorter-term mortgage so they can get out of debt faster and save money in interest over the life of their home loan. The example below shows how much you could save by refinancing now while rates are low, using the hypothetical mortgage loan above.

Assuming closing costs are 1.5% of the mortgage balance, they would be $3,257. Mortgage refinancing closing costs are typically rolled into the total amount of the loan, so your new loan plus fees would be $215,300.

Mortgage rates on a 15-year, fixed-rate home loan are 2.2% as of July 8, 2021, according to Freddie Mac. Here's what your new home loan would look like if you refinanced to a shorter mortgage term:

- New monthly payment: $1,405

- New total interest: $37,670

- Total amount saved: $84,700

As you can see, the monthly payment is $138 higher, but you're able to greatly reduce the cost of borrowing your mortgage.

This is just one example, but it's easy to see how much you can save by refinancing your mortgage. Use a mortgage payment calculator to estimate your monthly payment and interest savings based on your remaining balance.

VETERANS BORROWING VA LOANS AT A RECORD PACE, STUDY SHOWS

Option 2: Refinance to a 30-year mortgage to lower your monthly payments

Another reason why homeowners refinance is to lower their monthly payments. Since interest rates are so low right now, you may be able to stretch out your loan term to lower your monthly payment while still saving money over the life of your loan.

According to the same data from Freddie Mac, 30-year mortgage rates are 2.9%. Assuming a total loan amount of $215,300 including closing costs, here's what your loan terms would be:

- New monthly payment: $896

- New total interest: $107,312

- Total amount saved: $15,058

In the example above, you save $317 on your monthly mortgage payment. This cost savings can be put toward other monthly bills and even paying down high-interest credit card debt. And even though it will take a longer time to pay off the loan, you'll still save money over the life of the loan thanks to current mortgage rates.

If you're considering refinancing your mortgage, it's important to compare rates across multiple lenders to make sure you're getting the best possible mortgage rate for your situation. You can get preapproved to receive multiple mortgage offers in just minutes on Credible.

WHAT YOU NEED TO KNOW BEFORE MAKING A DOWN PAYMENT ON YOUR HOME

Option 3: Refinance to a 30-year mortgage and cash out on equity

Cash-out refinancing lets you take advantage of the equity you've built in your home by taking out a new, larger mortgage and pocketing the difference after paying your old mortgage. Home values are at historic highs, which means it might be a good time to cash in on some of that equity you've built in your home.

The median sales price for homes increased by 25% between 2013 and 2020, according to Census Bureau data. With that rate of growth, it's not out of the realm of possibility that the hypothetical home bought for $312,500 could be appraised at nearly $400,000 by July 2021.

To keep it safe and to avoid private mortgage insurance (PMI), let's say you take out a $300,000 30-year mortgage at a rate of 2.9%. Here's what your new mortgage terms would look like:

- New monthly payment: $1,249

- New total interest: $149,528

- Total cash access: $84,700

With a cash-out refinance, chances are you'll pay more interest since you're taking out a higher mortgage amount. But if you plan to put that money into home renovations or pay off high-interest credit card debt, then it may still be a worthwhile investment.

Mortgage refinancing can be a smart financial decision, and the cost savings can be significant. If you're still on the fence, get in touch with an experienced loan officer at Credible who can walk you through the process and help you make the best decision with your money.

SHOULD I GET A FIXED-RATE OR ADJUSTABLE-RATE MORTGAGE?

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.