June jobs report: US adds 850,000 jobs as economy extends its gains

U.S. employers added 850,000 jobs in June 2021, well above the average of the previous three months, the Labor Department said.

U.S. employers added 850,000 jobs in June 2021, well above the average of the previous three months, the Labor Department said.

Today's mortgage refinance rates level off at end of week | July 2, 2021

Check out the mortgage refinancing rates for July 2, 2021, which are unchanged from yesterday.

Check out the mortgage refinancing rates for July 2, 2021, which are unchanged from yesterday.

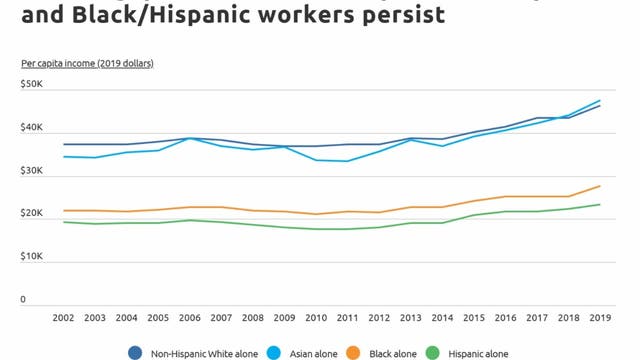

STUDY: Houston has third largest minority wage gap in the country

A recent study shows that Houston minorities in the workforce full-time make 41.2% less than non-minority workers.

A recent study shows that Houston minorities in the workforce full-time make 41.2% less than non-minority workers.

Volatile week continues with today's mortgage refinance rates | July 1, 2021

Check out the mortgage refinancing rates for July 1, 2021, which are a mix of up, down, and steady from yesterday.

Check out the mortgage refinancing rates for July 1, 2021, which are a mix of up, down, and steady from yesterday.

Today's mortgage rates hit every mark: up, down, and steady | July 1, 2021

Check out the mortgage rates for July 1, 2021, which are trending up from yesterday.

Check out the mortgage rates for July 1, 2021, which are trending up from yesterday.

How to refinance a vacation home

A few key differences make refinancing your vacation home a bit more challenging than refinancing your primary residence.

A few key differences make refinancing your vacation home a bit more challenging than refinancing your primary residence.

How to pay off $30,000 in credit card debt

Paying off high credit card debt is possible, but it requires planning and solid strategies.

Paying off high credit card debt is possible, but it requires planning and solid strategies.

Paying off credit card debt with a personal loan can save you $700 in interest

Struggling to pay off your credit cards? A personal loan can help you lower your monthly payments, save money on interest and pay off debt faster.

Struggling to pay off your credit cards? A personal loan can help you lower your monthly payments, save money on interest and pay off debt faster.

Consumer prices rising at historic pace: What it means for your personal finances

Risks of inflation are rising and consumer prices increased at their highest rate in more than a decade, driven by increasing auto prices.

Risks of inflation are rising and consumer prices increased at their highest rate in more than a decade, driven by increasing auto prices.

Hot housing market eliminates some risks from using cash-out refinances for student loans

Take advantage of the hot housing market and roll your student loans into your mortgage with a cash-out refinance.

Take advantage of the hot housing market and roll your student loans into your mortgage with a cash-out refinance.

Today's mortgage refinance rates all trend upward for first time since mid-March | June 30, 2021

Check out the mortgage refinancing rates for June 30, 2021, which are up from yesterday.

Check out the mortgage refinancing rates for June 30, 2021, which are up from yesterday.

Today's mortgage rates rise across 30- and 15-year terms | June 30, 2021

Check out the mortgage rates for June 30, 2021, which are trending up from yesterday.

Check out the mortgage rates for June 30, 2021, which are trending up from yesterday.

Does your child need life insurance? What to know

Should you take out a life insurance policy for your children? Here’s what you should know about child life insurance policies and when it makes sense to purchase one.

Should you take out a life insurance policy for your children? Here’s what you should know about child life insurance policies and when it makes sense to purchase one.

Child tax credit: Families who have higher 2021 earnings can opt out

Families who are earning more in 2021 but were receiving assistance through the child tax credit program may have become ineligible and will get a chance to opt out of those payments to avoid having to pay it back next April during tax season.

Families who are earning more in 2021 but were receiving assistance through the child tax credit program may have become ineligible and will get a chance to opt out of those payments to avoid having to pay it back next April during tax season.

Do I have to pay taxes on my savings account?

The interest you earn on the money in your savings account is considered taxable income in the year the interest was earned. The tax you pay is determined by your overall taxable income for that same year.

The interest you earn on the money in your savings account is considered taxable income in the year the interest was earned. The tax you pay is determined by your overall taxable income for that same year.

Could your credit score impact your ability to get a new job?

Make sure you know how your credit could influence your employment.

Make sure you know how your credit could influence your employment.

Rise in car loans boosts US consumer credit usage in April, Fed report shows

More people are buying cars as the pandemic lifts and the demand is causing costs to surge.

More people are buying cars as the pandemic lifts and the demand is causing costs to surge.

Heat wave relief: How to pay for a new air conditioning system

Several regions of America are experiencing a record-shattering heat wave, which is bad news for people without central air. Keep reading to learn more about air conditioning financing, and compare your financing options.

Several regions of America are experiencing a record-shattering heat wave, which is bad news for people without central air. Keep reading to learn more about air conditioning financing, and compare your financing options.

Ready to refinance a rental property? What to know

Refinancing a rental property can help you accomplish several financial goals, but lender requirements are stringent.

Refinancing a rental property can help you accomplish several financial goals, but lender requirements are stringent.

How to decide if student loan refinancing is right for you

Although refinancing your student loan can help you save money, it might not be the best option for you.

Although refinancing your student loan can help you save money, it might not be the best option for you.